07 Mar Data-Driven Market Expansion Identified by Artificial Intelligence

Market expansion, that is entering a new market to find new customers, is a bold move. But if your company’s share of its primary market is high and leveling out, increasing its total addressable market (TAM) may be the best move. There are potentially high rewards for entering a new market but the potential for risk is high too. So, how is this risk best mitigated?

Conventional wisdom for finding market adjacencies is to not stray too far from the core and to find natural adjacencies with built in tailwinds. Makes sense, but that’s pretty macro. So, the next level of risk mitigation is a whole lot of desktop work, report reading and expert interviewing. This effort culminates in a decision predicated on mostly secondary data. Having said that, it can still result in unique insights that lead to success. Here, however, I’m going to discuss a more procedural approach that can augment or replace traditional market expansion methods. This step-by-step process, enabled by smart tech, uncovers insights and commonality with data mining and artificial intelligence.

Here, however, I’m going to discuss a more procedural approach that can augment or replace traditional market expansion methods. This step-by-step process, enabled by smart tech, uncovers insights and commonality with data mining and artificial intelligence.

Smart products are highly competitive because they use proprietary customer data. It’s the difference between a smart car (Tesla) and a traditional car. The difference between a smart thermostat (Nest) and a traditional thermostat. And the difference between a smart TV receiver (Roku Streaming Stick) and a traditional cable box. In these cases, data is used for product innovation but different data, also collectable by a smart product, can be used to systematically discover new markets for itself. And this isn’t a one-off exercise. Once set, the smart product is constantly on the lookout for adjacent markets it’s being used in, and the corresponding features used.

A defining technical element of a smart product is its connection to the internet. Through networking, the company who made it, operates it or services it, has a proxy connection directly to the end customer. This connection opens a window into the customer’s world. By deploying a utility sim, it is possible to learn what the customer uses the product (service or environmental) for. This is correlated to the market the product is used in, but it is also used to analytically build a target persona for future customer acquisition purposes.

For market expansion purposes we use artificial intelligence to process the utility data. One capability of AI is to group similar things together. This is how spam filtering works. Once the AI model is trained on which utility parameters to look for, it can classify product configuration by customer segment. Associating customer segmentation with the market the product is used in allows its maker, operator or servicer to see the actual market adjacencies and the specific product configurations used there. This list is then sorted by attributes such as market size, growth or product requirements to prioritize the new markets to enter.

Using AI and data mining to discover market adjacency insights can augment or replace the traditional market expansion playbooks used today. The candidate list of market adjacencies is derived from primary data and only gets deeper and wider with time. Deciding on which market to expand into becomes a repeatable analytical exercise based on real customer data. And unlike traditional techniques, smart digital market expansion also determines the best product configuration and target persona for each potential new market.

HOW IT’S DONE

Selecting the best market to expand into is based on the best supporting data. Smart digital market expansion presents two streams of data: the adjacent markets where the product is currently being used and the best configuration of the product for that adjacency. The adjacent market data is either inputted by the customer or triangulated to by software within the product. Data on product configuration and features used is outputted by a utility sim using a digital twin and its AI or analytic model. Both sources of data are transported to the cloud using the internet of things where it is analyzed by a separate AI routine that is continuously improved over time.

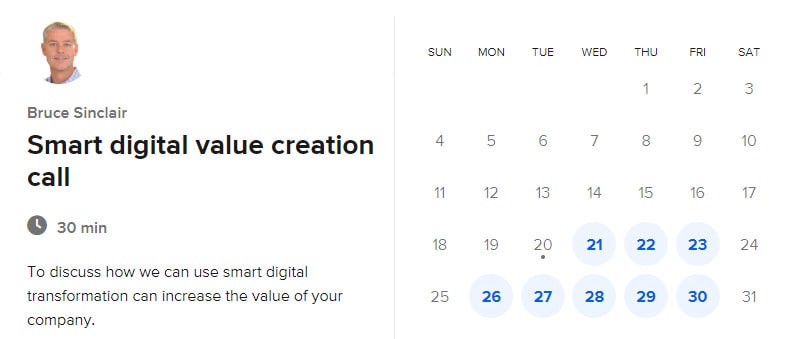

Contact us if you’d like to understand more or click calendar to schedule a free 30-minute consultation if you have a company to improve.