13 Nov The Full Tech Stack and Digital Twin for Value Creation in Private Equity

In private equity IT is almost always synonymous with technology. Nothing could be further from the truth, at least from a value creation perspective. IT plays an important role in integrating the business systems of an add-on in a buy and build, or replicating the business systems (lift & shift) in a carveout, but there’s plenty more sponsors can do with tech than just implementing back-office infrastructure. More importantly, there’s far more to value creation in PE than only IT. Here we discuss the full tech stack and when each layer is most effective for value creation. We also discuss the concept of the digital twin and its central role in the future of value creation.

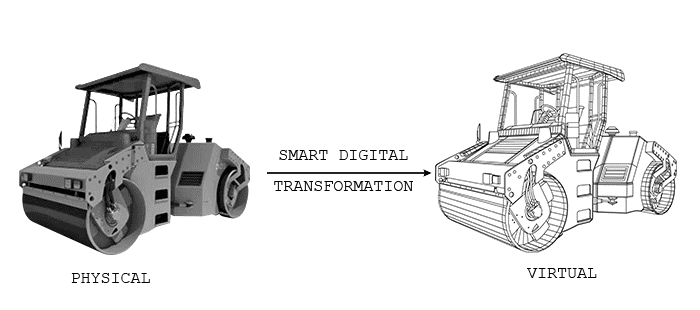

At a high level this means a company’s physical products, physical services or physical operations are digitized into a data science construct called the digital twin. Once something physical becomes digital it’s much more malleable and can be improved by applying a number of mathematical techniques.

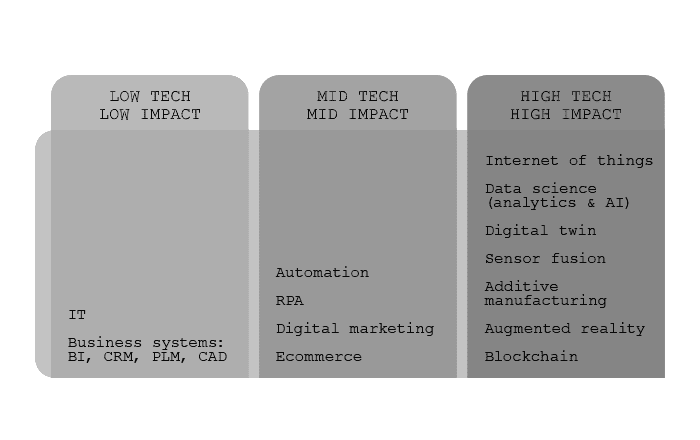

THE THREE LEVELS OF TECH

Digital value creation means technology, but in this context it’s important to distinguish the different types of technologies that can be put to work and when these technologies have the most impact. When it comes to PE value creation, there are three levels of technology: low tech, mid tech and high tech. Low tech includes IT and business systems such as, BI, CRM, PLM and ERP. Mid tech includes automation, RPA (robotic process automation), digital marketing and ecommerce. And high tech/smart tech includes the internet of things (IoT), data science (stats & AI/ML), the digital twin, sensor fusion, additive manufacturing, augmented reality and Blockchain.

WHICH TECH WHEN?

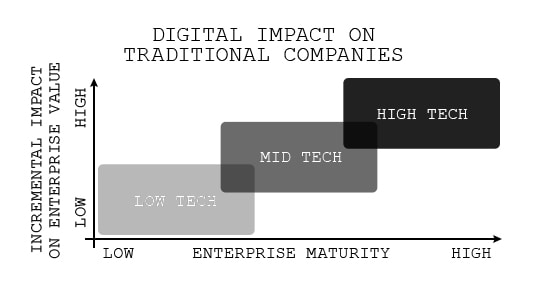

Low tech, mid tech, high tech. Any of these techs can be applied to create value at any company stage, but there is a natural sweet spot to maximize that value.

Early-stage companies, because they have likely incorporated high tech from the start, are not good candidates for smart digital transformation. But if they are still doing accounting using QuickBooks, then low tech, in the form of a business system, is valuable. Experience has shown that low tech has the most valuation impact on early-stage, venture-backed companies.

Conversely, mid-stage companies, in all likelihood, already have enterprise-level IT and business systems in place, so for them, low tech provides little incremental enterprise value. But mid tech, with its ability to automate repetitive human activities, is valuable. At this company stage it’s rational to implement mid tech to gather the lowest-hanging value fruit but more specialized high technology can also be bountiful. However experience has shown that mid tech has the most valuation impact on mid-stage companies – companies that are most likely later-stage venture or growth capital companies.

Mature companies, specifically traditional non-tech mature companies, have the most to gain from high/smart technology. They are of a vintage before today’s smart tech was invented. They already have low tech in place and most likely mid tech too. Though high tech is second nature to younger companies, the strategic use of smart technology is still relatively rare for mature companies. Experience has shown that high tech has the most valuation impact on late-stage, non-tech companies.

THE MONEY MAKER

Smart digital transformation is the transformation of a traditional company into a digital-traditional company by implementing a series of smart digital initiatives. At a high level this means a company’s physical products, physical services or physical operations are digitized into a data science construct called the digital twin. Once something physical becomes digital it’s much more malleable and can be improved by applying a number of mathematical techniques. The technology bridging the physical and digital worlds are the sensors and actuators of the internet of things. Digital twin simulations are made of software and data science models.

Bringing this back to earth, we can improve the effectiveness of the road roller by simulating paving. We can improve road roller service by simulating malfunction events and we can improve the manufacturing of the road roller by simulating the process of how it’s built. Furthermore, we can improve the business model of owning/using the road roller by simulating how it makes money for its owner. These are four examples of smart digital value creation but depending on perspective, there are hundreds more digital twins creating value in hundreds of other ways.

HIGH IMPACT SMART DIGITAL

For each stage in a company’s life cycle, there is a class of technology that delivers the greatest value creation impact. From the perspective of the mature, non-tech company, low tech has a low impact, mid tech has mid-level impact and high tech (smart tech) has a high impact.

High/smart tech creates value by transforming physical things into software-defined and data-driven things, and then applying mathematics and data science to their digital twins.

Smart digital value creation offers buyout firms a new value creation technique that’s accretive to existing value creation techniques. It can increase company valuation by growing sales (e.g., better road roller product), improving margins (e.g., better road roller service and better road roller manufacturing) and possibly the valuation multiple (e.g., better road roller business model). This proprietary data science approach represents one of the futures of value creation.