08 Dec The Competitive Advantage of Incorporating Smart Digital into PE Diligence

All things being equal, the highest bidder in a competitive auction is either more financially optimistic about the asset or they see something the other suiters do not. The common viewpoint sees traditional financial engineering and often a buy-and-build. But to find an edge during diligence this traditional perspective is being broadened by incorporating future operational improvements into the bid.

Incorporating smart digital value creation into diligence enables the sponsor to see value invisible to other value creation methods, possibly providing them with a new edge and the conviction to price the deal to win the bid. Smart digital is an adjunct investment theme that can be underwritten into most deals.

When considered during diligence, smart digital provides sponsors a competitive advantage by enabling them to see value invisible to other bidders.

WHAT IS SMART DIGITAL?

We’ve all heard of or own smart home devices, smart watches and smart cars. Well, it turns out that the adjective “smart” can be put in front of any physical thing or operation or software by a process called smart digital transformation. This thematic investment capitalizes on the smart mega trend that’s digitalizing all sectors.

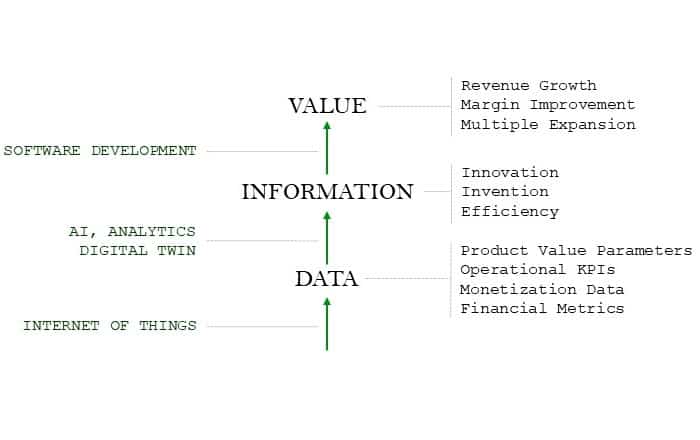

It’s important to differentiate between the technology used in smart digital and low tech, such as IT and business systems, and mid tech, such as automation, RPA, digital marketing and ecommerce. To create smart things or smart operations or smart software or smart business models we use high tech, such as AI & analytics, the digital twin and often the internet of things.

At the heart of smart digital value creation is capturing proprietary data – proprietary customer data, proprietary operational data and proprietary monetization data that wasn’t available before. Proprietary customer data is used to improve products/services and the customer experience. Proprietary operational data is used to improve the productivity of business operations. And proprietary monetization data is used to reduce monetization friction resulting in improved business models and possibly entirely new ones.

WHY IS SMART DIGITAL IMPORTANT?

Smart digital is an important addition to the diligence process and value creation in general because of its scope of options available.

Most traditional value creation methodologies focus on increasing efficiency to lower OPEX and COGS by improving the operations of sales, of service, of purchasing, of manufacturing or of G&A. Smart digital, using proprietary data from a company’s operations, improves existing operational improvement methods and introduces smart new ones that are accretive.

In addition to improving operational effectiveness, smart digital can target topline growth. By analyzing proprietary customer data, companies can see how customers use their products/services, what they use their products for and how their products perform. With the right experience and planning this data can be interpreted for better customer retention, market share expansion, customer expansion, product expansion, market expansion and pricing optimization.

Furthermore, traditional companies can now see, with high fidelity, how their customers earn money with their product or service. This powerful insight leads to improving existing revenue models and deploying entirely new business models creating a win:win for both parties. Improved business models increase revenue, sure, but new business models are also the foundation upon which most markets have been disrupted.

But it doesn’t need to be so dramatic. Although the rare market disruption would be a big win, even enabling a recurring revenue model is a homerun that can bat in a higher exit multiple when considered along with the other structural changes (new intangible assets and digital team) made to make the company smart.

PERFORMING SMART DIGITAL DILIGENCE

Smart digital value creation takes a top-down approach. First, the value to be created is identified. Then, the data required to create that value is identified. Next, any of the identified data that is unavailable is “created” by deploying the corresponding sensors for traditional and tech companies or by calling new API calls for software companies.

The profound take-away from this top-down diligence approach is in virtual space we can conjure up the exact data we need for value creation. During diligence this means we can be far more creative in how we find value and where we can look for it.

Smart digital diligence then is an exercise of imaging the value we want to create and building value sims by connecting the dots between important business metrics and the data we need to capture. The main categories of business metrics to take into consideration include:

- Yardstick metrics such as internal operational KPIs and external sector KPIs.

- Product/service metrics that leads to revenue growth and margin expansion.

- Monetization metrics leading to business model development.

- Financial metrics to support of the overall investment thesis.

Imagining the value we want to create comes from these metrics and others, and from experience in pattern matching to value successfully created for similar assets in the past.

Practically, a smart digital investment theme is developed and a grade given during diligence. Then, depending on the fidelity required, the theme and grade can be expanded into the smart digital investment thesis.

CONCLUSION

Smart digital is a new value creation option for traditional, tech and software companies that’s accretive to current operational improvement methods. Smart digital diligence is desktop work that doesn’t require access to company management and by its nature it’s actionable, so if the asset is eventually acquired, the value creation process picks up directly from where the diligence process left off. When considered during diligence, smart digital provides sponsors a competitive advantage by enabling them to see value invisible to other bidders.