11 Jan Boosting Buy & Build Performance with Smart Digital Outcomes

The buy & build is the most popular form of value creation. And kind of like what debt was in yesteryear, its returns are for now are almost automatic. Buy a platform company and add on a few smaller ones to it and voila, their value is greater than the sum of their parts. Of course, I’m exaggerating with the “voila” part, I’ve witnessed firsthand the human and technology integration challenges from doing this, but the fact of the matter is, investors pay higher multiples for bigger companies.

This is good… no, this is great, but how do we make this strategy more profitable for our fund than our competitors’ and how do we guard against its commoditization? While the market values efficiency, that is, reducing redundancy between grouped companies, when smart digital is involved it can also improve revenue growth, something the market values even more. Smart tech does this by enabling outcomes.

While the market values efficiency, that is, reducing redundancy between grouped companies, when smart digital is involved it can also improve revenue growth, something the market values even more. Smart tech does this by enabling outcomes.

Outcomes. This is a topic I explored extensively in my first book, IoT Inc: How Your Company Can Use the Internet of Things to Win in the Outcome Economy, published by McGraw Hill. It is the business strategy of focusing on the results the customer actually wants rather than the focusing on common narrative of customer pain points. Only the smart tech of artificial intelligence and the internet of things can “wire” together different point solutions to enable them to work together to deliver wanted outcomes. As an add-on strategy it leads investors to look at the sourcing and technical integration of a buy & build in a different, often more valuable way.

Sourcing. The cerebral part of buy & builds is deciding on what direction to look when sourcing for add-on companies to buy. Most common is to survey the horizon horizontally for integrations. A potentially more profitable yet riskier approach is to look toward expanding into new markets through various adjacency expansion strategies. But instead of having that discussion now, I’d like to introduce the outcome integration strategy.

In every sector different types of point products from different vendors are cobbled together by the customer to achieve the outcome they want. Consider, for example, one of my past clients: a large family-owned pest control company.

One of the new verticals they were expanding into was the commercial bakery market. Of course, these food factories didn’t want rodents (pain point) but the outcome they really wanted was to produce a food-safe environment that passed inspection. It turns out that to achieve this outcome, sanitation (to keep the environment clean so rodents aren’t attracted to it) and construction (to keep rodents out of the environment in the first place) were equally important to reach the desired outcome. This forced our prospects to work with three different industry solutions. From an M&A perspective this insight directed our sights toward sanitation and construction companies.

Integration. Outcome-based sourcing is valuable in itself, but we can use smart tech to integrate the products of the acquired companies with those of the platform company to enable the different products to work together. This doesn’t diminish their stand-alone value but when working together to achieve an outcome their value is compounded. Going back to our example, the value creation opportunity was not only to integrate the pest control, sanitation and construction services, but to also use smart tech to integrate the various equipment and certification software used.

Conclusion. Here I offer a new lens from which to spot add-on companies and a new way to integrate their products. Unlike consolidating IT systems, orchestrating multiple products to work together produces not only a more innovative solution, but a less expensive one too. This can lead to exponential value gains and even novel business models. Upon divestiture the outcome integration strategy can further boost the exit multiple, and as a bonus, it also provides a long runway of potential target companies the next owner can acquire.

HOW IT’S DONE

To integrate the pest control, sanitation and construction equipment the first step is to virtualize them using the digital twin with the appropriate sims. Technically, this is known as a cyber-physical system enabling physical equipment to act as software and to be acted upon by AI and analytics. The different equipment is connected to each other by the internet of things through an API connected to middleware, also known as a “platform”. In the future, this technical platform can enable new 2-sided business models by acting like an OS or app store, to allow other vendors to extend its functionality and value.

To integrate the certification software, the most robust application of the three is rearchitected to manage all I/O and to be the command-and-control body with API hooks. The other two application are abstracted and communicate with the main app through the API.

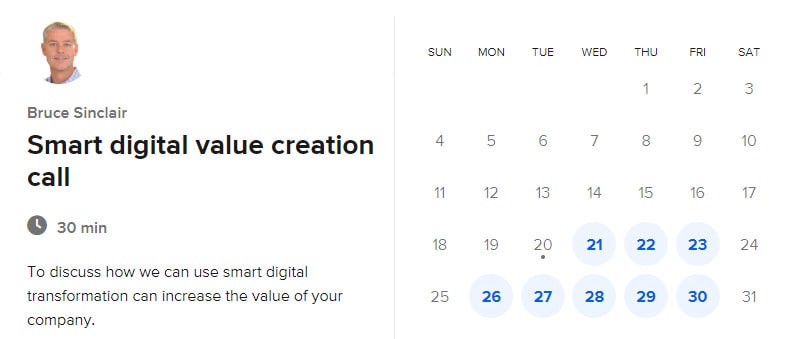

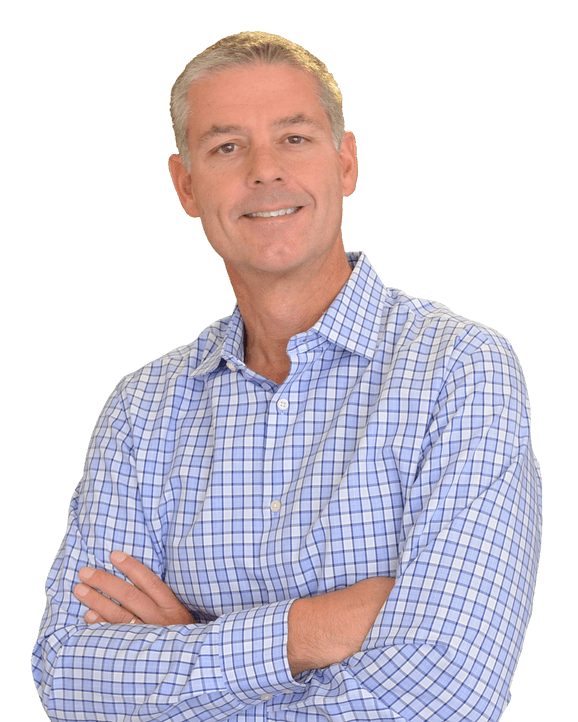

Contact us if you’d like to understand more or click calendar to schedule a free 30-minute consultation if you have a company to improve.