15 Dec Smart Digital Transformation by the Numbers

Digital transformation has been in the technical press for years; geeking out on everything from the merits of low-level network protocol design to high-level platform architecture. That’s all good for a nerd like me, but now that the technology of smart digital transformation has matured, it’s time to discuss it from a financial perspective—in particular, from the financial perspective of the leveraged buyout firm. Why? Because it’s a perfect fit for GP portfolio companies, and the risk no longer lies in the high technologies used, such as the internet of things (IoT) and AI (machine learning), so smart digital transformation is ready to be put to work as a value creation tool.

There are as many definitions of digital transformation as there are different interests in it, but from our perspective, the perspective of maximizing enterprise value, smart digital transformation is the transformation of a traditional company into a digital-traditional company through one or more digital initiatives. Digital enables us to operationally transform most types of portfolio companies into the type of companies that have the highest valuations: tech companies. For example, there are traditional companies like taxicab companies that operate in the physical world and digital companies like Uber that operate in both the virtual and physical worlds. Both roughly do the same thing, but the one that is more valuable is obvious.

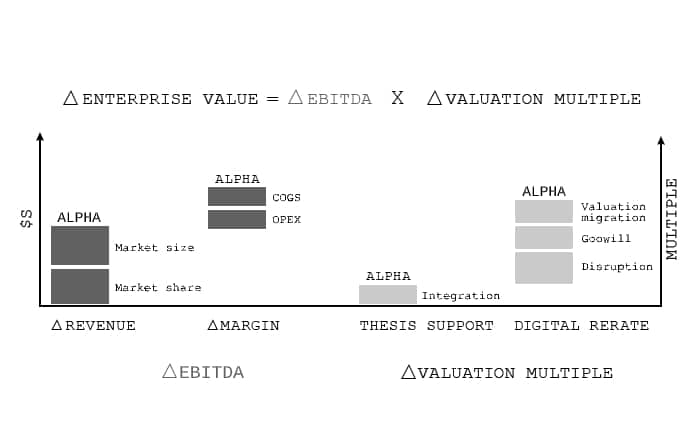

As a value driver, smart digital transformation has it all. Not only does it employ digital initiatives to turn down COGS and OPEX, but it can also turn up the two biggest knobs of enterprise value: revenue growth and the valuation multiple. Let’s take a look.

REVENUE

When considering operational improvements as measured by EBITDA gains, the X factor is revenue growth. Revenue solves all problems. Whether from inorganic growth or price rationalization, it’s all good, but the most coveted growth comes from increasing market share and market size—both being the sweet spots of smart digital transformation because they’re both the sweet spots of digital companies. Smart digital transformation galvanizes innovation to improve products/services and gain market share, and invention to create new products/services and gain market size.

Smart digital transformation supports innovation and invention that, in turn, supports a steeper growth profile—a growth trend that is sustainable because going digital is a structural change, not a short-term blip in cash flow.

PROFIT MARGIN

In general, margin expansion with smart digital transformation is about using data science to reduce costs and expenses through operational efficiency. Analytics and AI/ML is used to interpret data from the portfolio company’s operations sensors to improve one or more of asset utilization, human capital utilization, production yield, availability, capacity, performance and quality. Operations are quantified and then efficiency/performance models are developed, improved and interrogated to provide useful information to improve profit margin.

VALUATION MULTIPLE

In addition to taking advantage of arbitrage, negotiation skills and market inefficiencies, the job at exit is to convince the buyer that the asset for sale is well positioned for future growth and profitability—to substantiate its premium valuation multiple. The structural changes from being digital can be a strong company-specific component of the narrative used to substantiate an increase in the growth profile and a decrease in the risk profile of future cash flows. Digital helps accomplish this in two ways: in the support of the nondigital investment thesis and by taking advantage of the digital rerate.

Most operational improvements in private equity deal in percentages. Percentage of costs, percentage of working capital and percentage of price, which yield fractional improvements. Smart digital transformation can hit harder with whole-number improvements in EBITDA and the valuation multiple on exit.